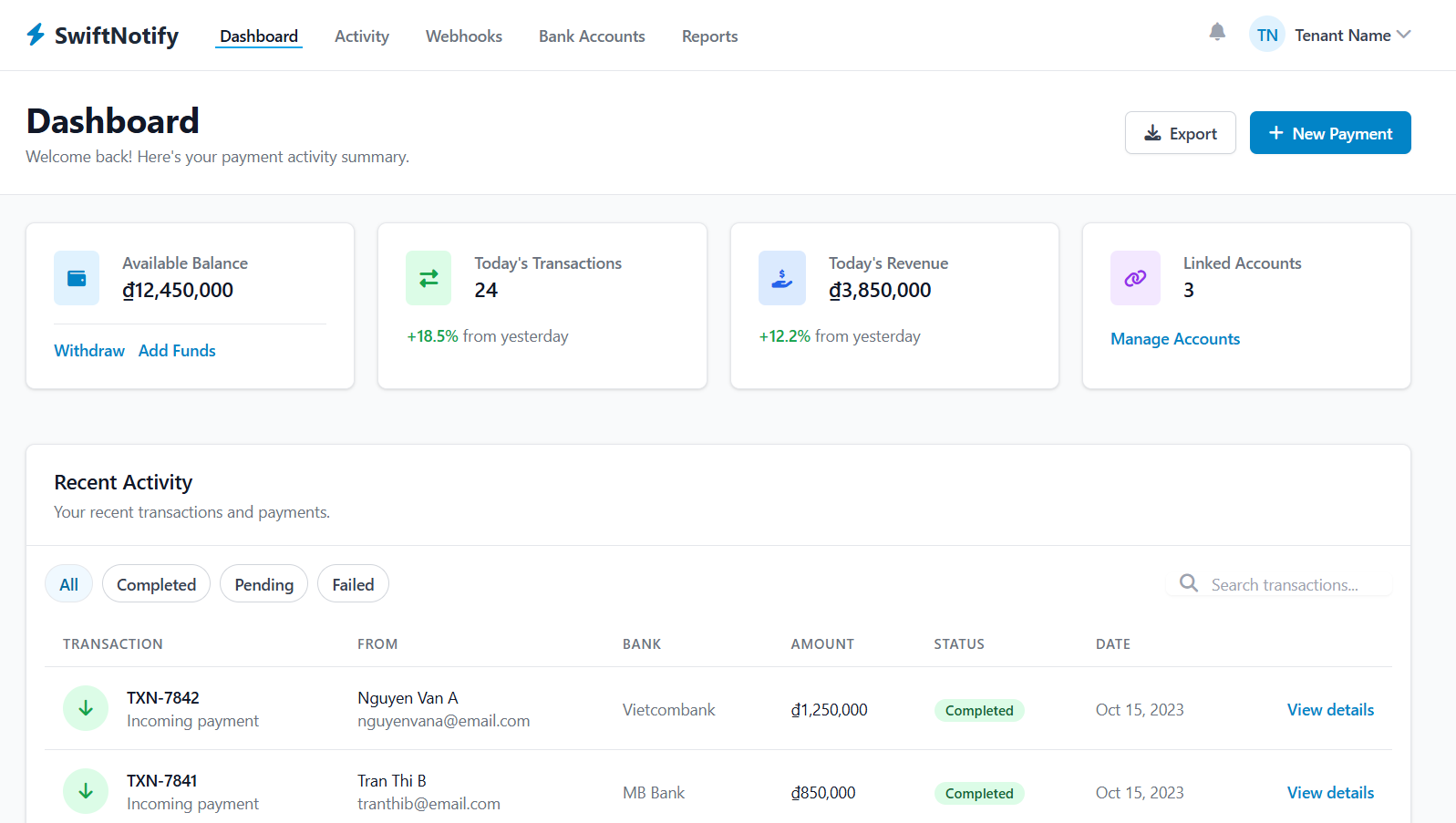

SwiftPay AutoConfirm is ideal for businesses that want instant notification and automated order processing. With real-time transaction updates delivered via webhook, you can streamline your workflow while keeping full control of your funds.

Note: This is one-way notification only. The service does not handle the actual money transfer—it only informs you when a payment has been made.

Pros

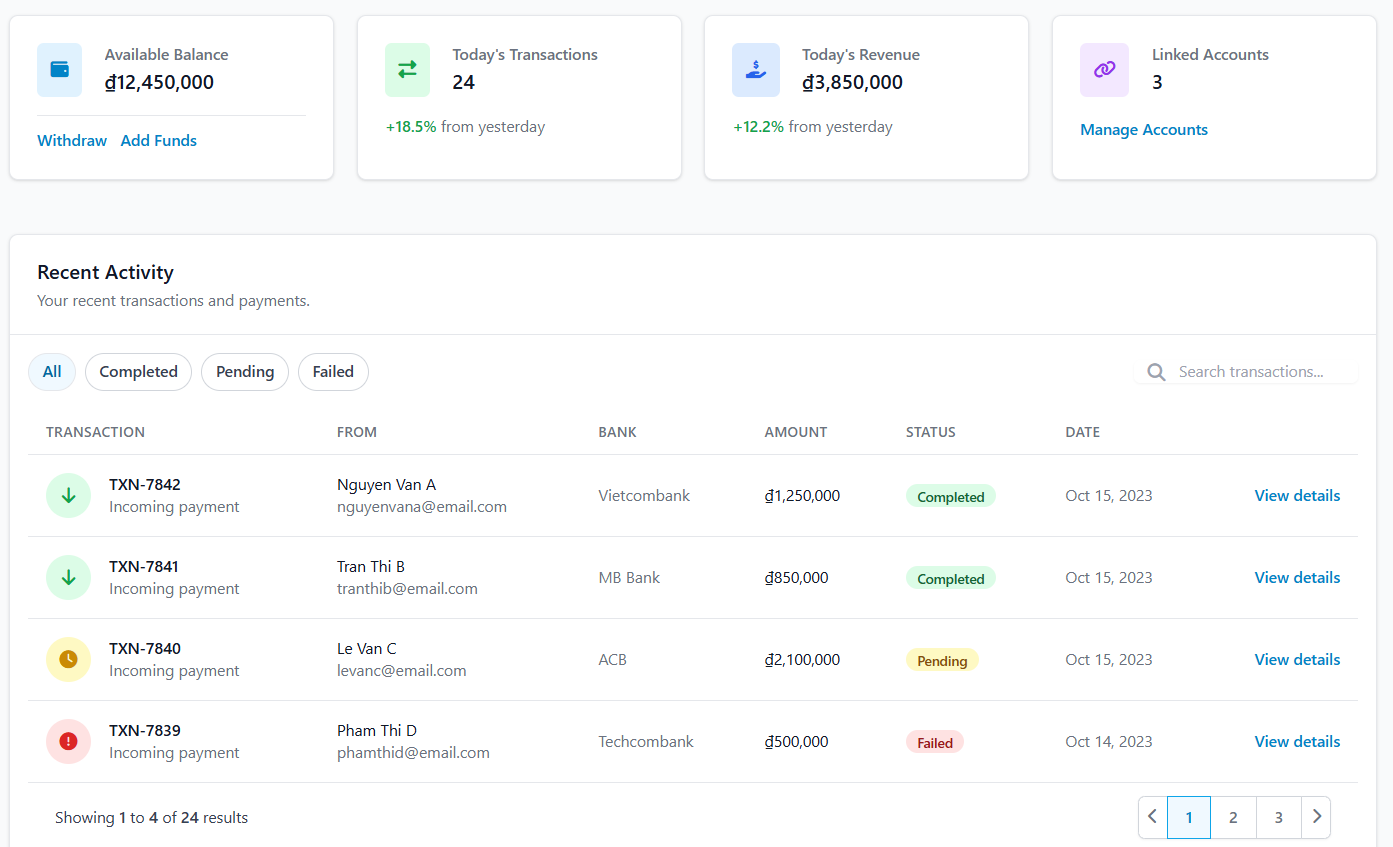

- Real-Time Notification: Instantly know when a customer makes a transfer.

- Automatic Processing: Connect to your system to confirm orders, update inventory, or trigger fulfillment.

- Multi-Bank Support: Works with Vietcombank, MB Bank, ACB, Techcombank, TPBank, Sacombank, BIDV, and more.

- Free Tier: Receive up to 50 order notifications per month for free.

Cons

- Funds Remain in Your Bank Account: SwiftPay AutoConfirm only notifies—you still receive money in your own bank.

- Minimum Transfer Amount: 100,000₫ per transaction.

- Reconciliation Timing: Transfers are reconciled twice a week, so notifications may be grouped for processing.

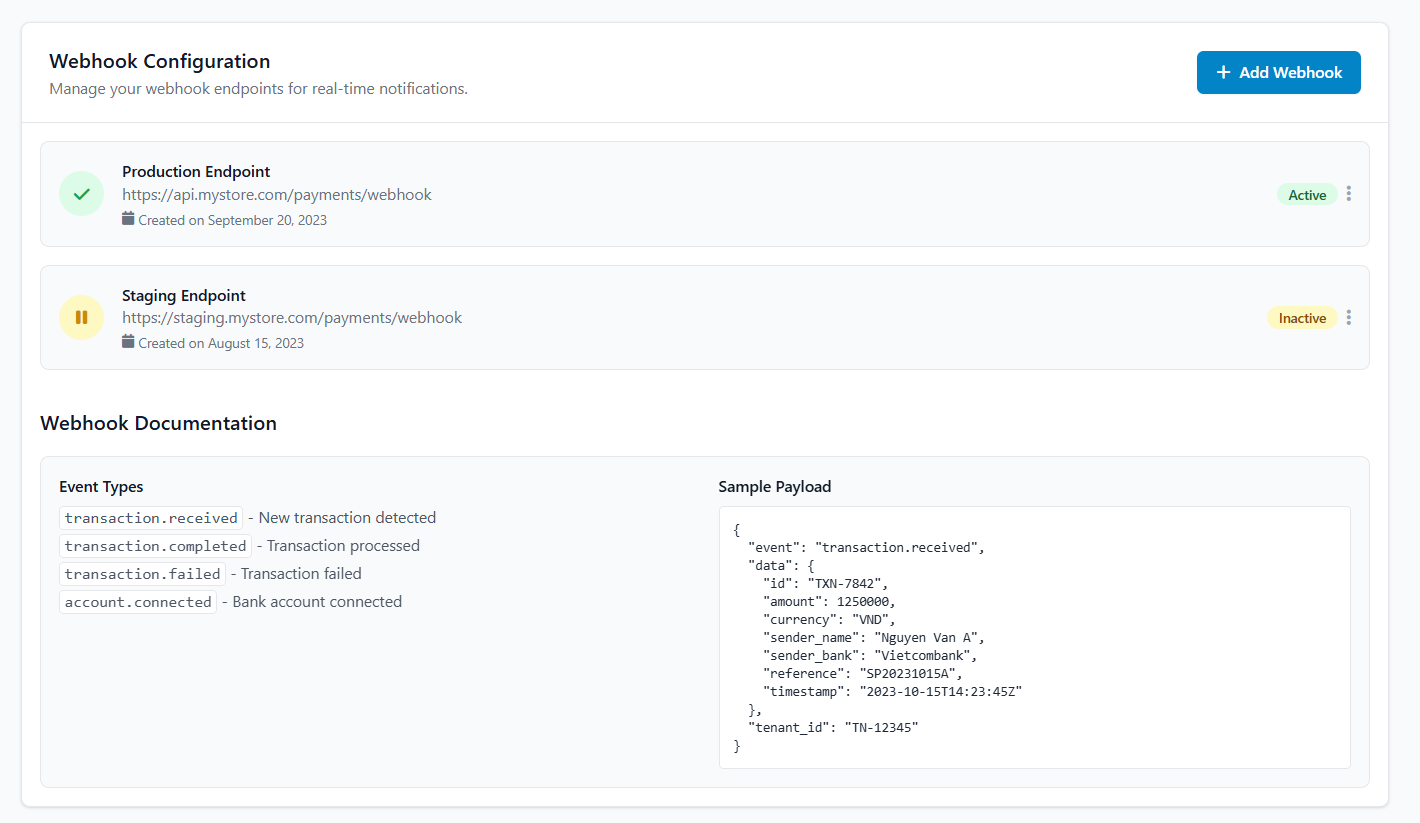

Webhook Configuration Tutorial

You can manage multiple endpoints for production and staging environments to integrate seamlessly with your system.

Step 1: Add a Webhook Endpoint

-

Navigate to Webhook Settings in your SwiftPay AutoConfirm dashboard.

-

Click “Add Webhook”.

-

Enter your endpoint URL:

-

Production Endpoint:

Status: Active

-

Staging Endpoint:

Status: Inactive

-

Save the webhook. You can add multiple endpoints for testing or different environments.

Step 2: Event Types

SwiftPay AutoConfirm supports several webhook events:

| Event | Description |

|---|---|

transaction.received |

A new transaction has been detected. |

transaction.completed |

Transaction has been processed successfully. |

transaction.failed |

Transaction failed. |

account.connected |

Bank account successfully connected. |

Step 3: Sample Payload

When a webhook event is triggered, your endpoint will receive a JSON payload like this:

Fields explained:

-

event– Type of webhook event -

data.id– Transaction identifier -

data.amount– Transaction amount -

data.currency– Currency code (VND) -

data.sender_name– Name of the sender -

data.sender_bank– Bank of the sender -

data.reference– Reference provided with the transaction -

data.timestamp– Time of the transaction in ISO 8601 format -

tenant_id– Your unique tenant identifier

Step 4: Handle Webhook in Your System

-

Configure your server to accept POST requests at the webhook endpoint.

-

Parse the JSON payload.

-

Take action based on the event type, for example:

-

transaction.received→ confirm order in your system -

transaction.completed→ mark payment as completed -

transaction.failed→ notify the customer or retry

-

Tip: Always respond with HTTP 200 OK to acknowledge successful receipt of the webhook.

Tiếng Việt

Tiếng Việt